camarilla. cam·a·ril·la. A group of confidential, often scheming advisers; a cabal.[Spanish, diminutive of cámara, room, from Late Latin camera. See chamber.] Discovered in 1989 by a successful bond trader in the financial markets, SureFireThing's 'Camarilla' equation (original) quite simply expounds the theory that markets, like most time series, have a tendency to revert to the mean. In other words, when markets have a very wide spread between the high and low the day before, they tend to reverse and retreat back towards the previous day's close. This suggests that today's intraday support and resistance can be predicted using yesterday's volatility.Our calculator not only contains SureFireThing's unique Camarilla {b} Equation, but also the original version of SureFireThing's Camarilla Equation, should you already have solid trading experience.Check out the interesting results of using the calculator for stock market day trading as far back as the Great Crash of 1929! |

The SureFireThing Camarilla Equation offers you 8 points of intraday support and resistance, the most important of which are the 'L3' and 'H3' levels. Trading with these levels can be difficult for some less experienced traders, as the system often generates a large number of intraday signals, both with and against the trend, requiring quite a high level of concentration and trading experience. More experienced traders, however, usually find it extremely profitable, and even 20 year veterans are often amazed at how accurately the levels highlight intraday support and resistance. |

The SureFireThing Camarilla Equation will astound you with its intraday accuracy. As a tool for the more experienced trader, it requires a willingness to 'buck the trend', but also a solid grounding in trading, as one needs good experience in order to know when to exit trades. The SureFireThing Camarilla Equation is ideal for experienced traders - even if you are making money already, the Calculator can help you 'supercharge' your trading and move you on up to the next level. If you sign up for any of our services, you also get access to our unique annotated charts showing how we traded the S&P on any particular day. These charts usually clear up any questions experienced traders may have about using the original equation. The Camarilla {b} Equation, on the other hand, is only available on this website, and is eminently suitable for both beginners and advanced traders. Charts for the {b} version are also provided to members. |

Having trouble following the topic of discussion when someone throws out the words “Camarilla Equation” at your local trader happy hour? Relax. I’ve got a quick primer for you that will remove the cloak of secrecy from this fascinating price-based indicator.

- Camarilla pivot point formula is the refined form of existing classic pivot point formula. The Camarilla method was developed by Nick Stott who was a very successful bond trader. What makes it better is the use of Fibonacci numbers in calculation of levels. Below is the quote of famous trader Nick Stott.

- May 29, 2021 Advanced Camarilla Pivot Calculator If you don’t have the Camarilla pivot points indicator, we recommend using the Camarilla calculator HERE. What we like about this Camarilla pivots calculator is the fact that it comes with an extra two levels of resistance (R5 and R6) and two extra levels of support (S5 and S6).

Simply put, the Camarilla Equation is a price-based indicator that provides a series of support and resistance levels, much like the Floor Pivots indicator. However, what makes this indicator unique is the fact that each pivot carries a specific call to action. That is, this indicator is usually color-coded to indicate whether you should buy or sell at certain pivot points. We’ll get to this in a moment.

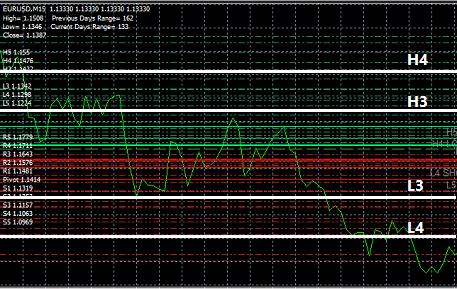

The equation takes the prior day’s high, low, and close prices to determine ten key levels on your charts; five support levels (L1 to L5) and five resistance levels (H1 to H5). The equation is as follows (keep in mind that RANGE is the high price minus the low price of the prior session):

The Camarilla Equation offers a powerful method of trading the market because the call to action is always the same. The equation forces you to recruit your inner discipline to trade on the right side of probability. Traders take similar positions at each level, thus creating a powerful form of self-fulfilling prophecy. Moreover, the pivot levels in the indicator are usually color-coded to remind you which actions to take when certain pivot levels are tested. For example, the H3 and L4 pivot levels are typically colored red because these are the zones where you should be looking to sell the market. Likewise, H4 and L3 are typically colored green to indicate long action levels.

Mar 13, 2021 This is the calculation of PP (pivot point). The calculation is the one utilized in calculating the same old pivot point. You can usually be the first one to read my analyses in the technical analysis phase of the admiral markets internet site. Advanced camarilla mt4 Strategy indicator. Camarilla tiers. Apr 26, 2014 Camarilla pivot point formula is the refined form of existing classic pivot point formula. The Camarilla method was developed by Nick Stott who was a very successful bond trader. What makes it better is the use of Fibonacci numbers in calculation of levels. Below is the quote of famous trader Nick Stott.

If you take action at the third layer of the indicator (ie: sell at H3, or buy at L3), your target then becomes the opposite pivot point. Therefore, if you sold at H3, then L3 becomes your target. If you bought at L3, then H3 becomes your target. In essence, the third layer of the indicator is usually reserved for reversal plays.

The fourth layer of the indicator (H4 and L4) is usually reserved for breakouts, although these levels can offer razor sharp reversal opportunities as well. If you play a bullish breakout through the green H4 level, then H5 becomes your target. If you play a bearish breakout through L4, then L5 becomes your target. Keep in mind that the fifth layer of the indicator can have varying formulas, depending on which version of the equation you find.

The first and second layers of the indicator (L1, L2, H1, and H2) are typically ignored and generally not even plotted. However, I will explain the best times to use these “hidden layers” in a future blog post.

Take at look at the 5-minute chart of MasterCard, Inc. (ticker: MA) for a brief diagram of the types of opportunities you can find using the Camarilla Equation.

Camarilla Advanced Calculator Formula Sheet

Remember, this is a very basic look at the Camarilla Equation. Much like the other forms of price-based indicators I use, the Camarilla Equation lends itself perfectly for higher levels of analysis, like pivot width analysis, pivot trend analysis, and two-day pivot relationships. I’ll break these concepts down in future blog postings.

Camarilla Advanced Calculator Formula

Now that the cloak has been removed, what do you think?

Advanced Calculator With Fractions

Frank Ochoa

PivotBoss.com

Calculator

Follow Frank on Twitter: http://twitter.com/PivotBoss